Table of Contents

- How do users manage finances currently?

- What features do users value most?

- Exploring new financial management tools

- User Journey

Overview

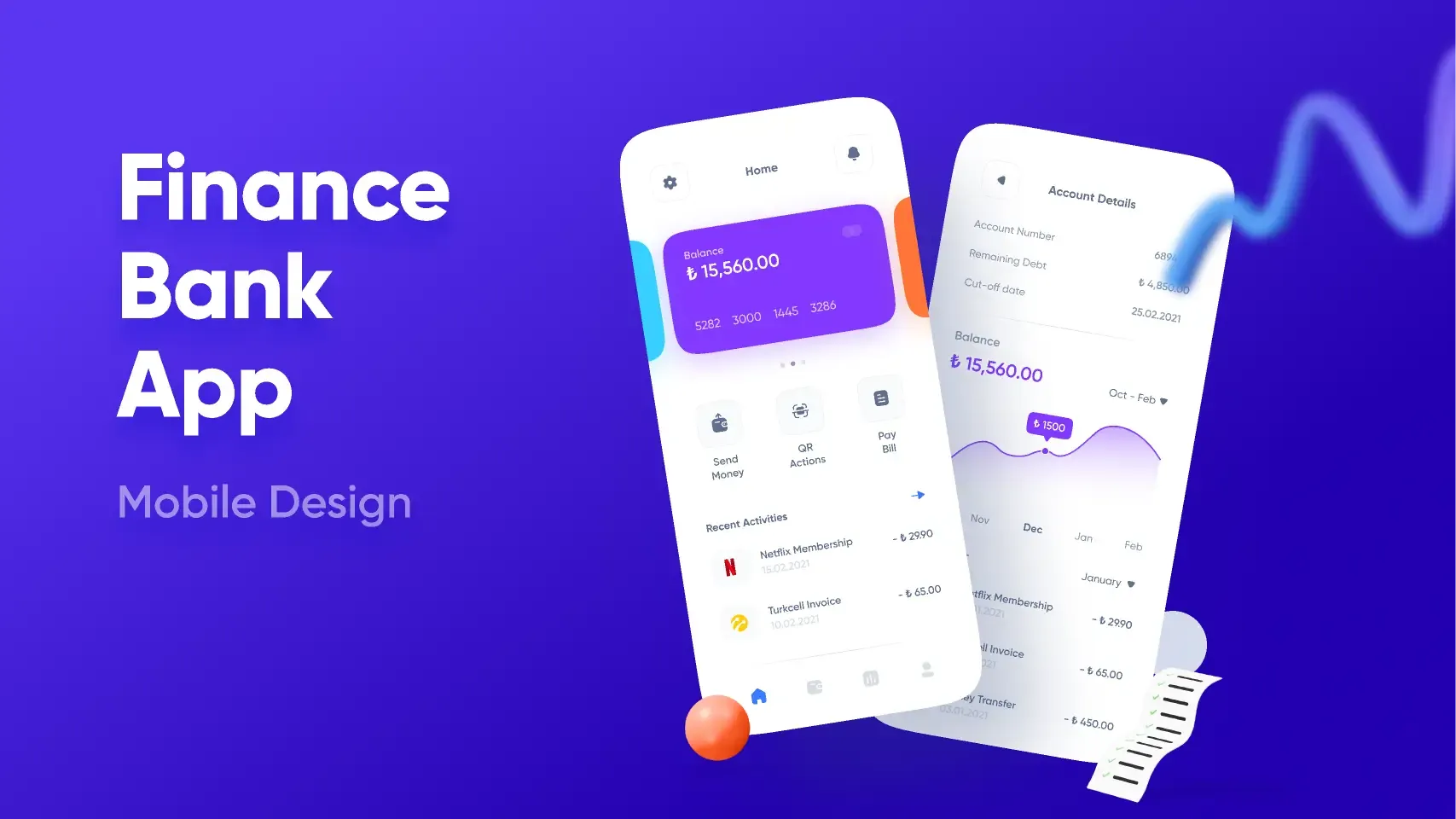

BudgetWise is a mobile application designed to help users manage their personal finances efficiently. Built using React Native, Expo, and TypeScript, it aims to provide a seamless experience for users to track expenses, set budgets, and visualize financial goals.

The app bridges the gap for individuals struggling to organize their financial habits by offering a modern and intuitive solution.

👨💻 Role

Lead Developer and UI/UX Designer

❓ Problem

Many individuals face difficulty in:

- Tracking daily expenses consistently.

- Setting realistic budgets and sticking to them.

- Understanding their spending patterns due to lack of clear visualization tools.

🎯 Goal

- Simplify the process of tracking expenses and setting budgets.

- Empower users to make informed financial decisions with intuitive visualizations.

- Increase user engagement by gamifying goal setting and achievement.

✨ Solution

How do users manage finances currently?

We conducted a survey of 20 individuals and found:

- 65% use spreadsheets but find them time-consuming.

- 25% rely on physical notes or memory.

- 10% use financial apps but feel they are overly complicated.

What features do users value most?

Survey participants ranked the following features as most important:

- Expense categorization.

- Budget-setting tools.

- Goal progress visualization.

Exploring new financial management tools

We designed a dashboard that combines:

- Categorized Expense Tracking: Auto-categorizes based on transaction type.

- Budget Alerts: Real-time notifications when nearing budget limits.

- Savings Gamification: Rewards users for hitting their financial goals.

User Journey

- Onboarding: Users input financial goals and monthly income during sign-up.

- Expense Tracking: Add expenses manually or sync with bank accounts.

- Budget Monitoring: Dynamic dashboards display budget status.

- Goal Tracking: Progress is visualized with charts and milestones.

🧪 User Testing

We tested the prototype with 12 participants and discovered:

- Ease of Use: 10/12 users appreciated the minimalist design.

- Notifications: 8/12 felt the alerts were helpful, but some found them intrusive.

- Visualization: All users loved the goal progress charts but suggested adding weekly summaries.

⚙️ Challenges and Learnings

- Real-Time Data Synchronization: Ensuring seamless bank account integration while maintaining security was a technical hurdle.

- Balancing Notifications: Finding the right frequency for alerts to avoid overwhelming users.

- Accessibility: Testing with colorblind users led to revising the color scheme for better visibility.

✨ Final Thoughts

- Data Security is Paramount: Financial data requires robust encryption and secure APIs for user trust.

- Iterative Design Works: Continuous user feedback helped refine the app to meet real needs.

- User Education is Key: Some users lacked basic financial literacy, so adding educational tips and videos enhanced their experience.